Understanding Your Tax Obligations: Reporting Airdrops and Staking Rewards to the IRS

The rise of cryptocurrencies has ushered in a new era of investment opportunities, including mechanisms like airdrops and staking rewards. However, along with these benefits come tax obligations that all crypto enthusiasts must understand. In this article, we will clarify how you can report your airdrop earnings and staking rewards on your income tax return as per IRS guidelines.

A Cloudy Landscape: The Nature of Airdrops

Airdrops occur when cryptocurrency projects distribute free tokens to existing holders or potential users, usually as part of a marketing strategy or network launch initiative. For example, if you hold Bitcoin in your wallet and receive Ethereum tokens without any purchase obligation from you, you’ve received an airdrop.

According to IRS regulations on virtual currency transactions outlined in Notice 2014-21, the receipt of tokens through an airdrop is considered taxable income at fair market value on the date they are received. This means if you get an airdrop worth $500 when it is issued, you need to report that value as ordinary income on your tax return for that year.

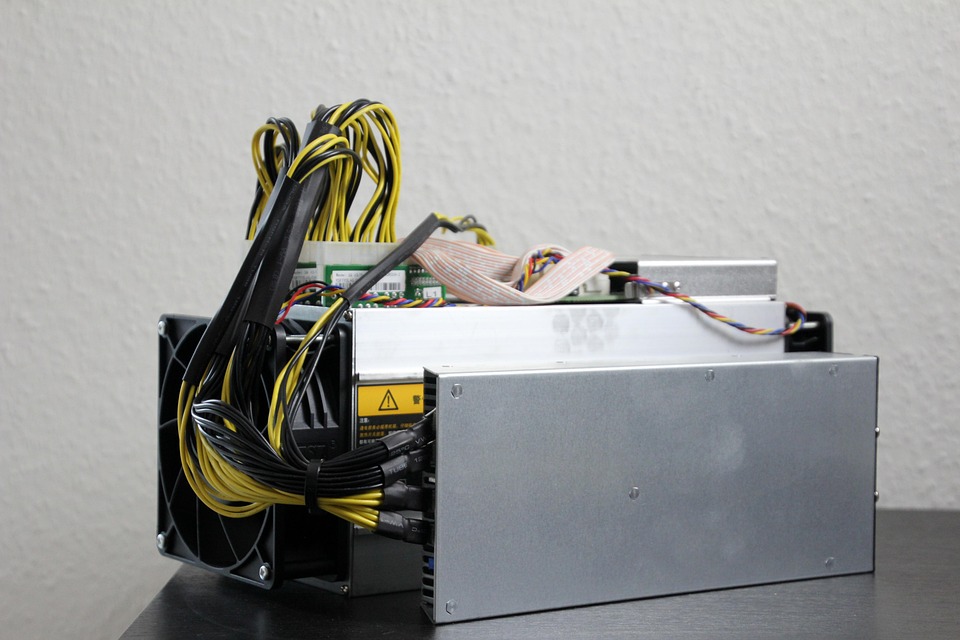

The Mechanics Behind Staking Rewards

Staking involves participating in blockchain networks by holding funds in a cryptocurrency wallet to support operations such as block validation and transaction processing. In exchange for this service, stakers often earn additional coins or tokens known as staking rewards. These too are subject to taxation under current IRS rules.

Your staking rewards are counted as taxable income once they become accessible—typically when they’re credited to your account—at their fair market value at that time. If your staking reward amounts to 2 Ether valued at $300 each during the distribution period (totaling $600), you’ll be required to declare this amount as income for that year.

Diligent record-keeping is crucial when reporting cryptocurrency-related activities like airdrops or staking rewards. Here are some essential practices:

- Date Received: Keep track of dates when funds were received through both methods; knowing precise timing helps establish accurate valuations based on fluctuations in coin prices.

- Fair Market Value: Record the fair market value (FMV) at which assets were acquired since it determines how much taxable income needs reporting.

- Total Amounts Earned: Summarize totals across various projects throughout each fiscal year for simplified calculations while preparing taxes.

Navigating Challenges: Determining Fair Market Value

An ongoing challenge arises concerning establishing FMV due primarily because cryptocurrencies do not possess fixed values; their prices fluctuate significantly daily based upon demand/supply dynamics within trading platforms offering them globally.

Several exchanges list average price quotes via historical averages where trades occurred across markets – utilizing data from reliable sources assists taxpayers ensure comprehensive compliance!

The Consequences of Non-Compliance

If individuals failto report their gains accurately,before deadline there might be potential repercussions ranging penalty fees towards unpaid taxes alongside possible audits initiated over multiple years should discrepancies arise amongst submissions made! Thereforetaking proactive measures collectively enforcing thorough & timely filings reflects positively long-term intentions while remaining engaged properly governing financial interactions pertaining digital currencies!

Your Path Forward: Seeking Professional Guidance

If you’re uncertain about how best tackle compliance surrounding these evolving landscapes associated both air drops plus updated protocols concerning responsibilities topics—consider consulting certified public accountants familiar intricate nature implied investments where legal requirements intertwine seamlessly tech advancements ahead protect proactively amidst emerging regulatory frameworks faced continuously future unsure elements persevering steadily flourishing successfully financially wise channels remain open approaching horizons daily planning journeys unfold into lives diligently thus thriving uninhibitedly allowed strive reach goals dreams effectively fulfilled reciprocally.”